Uncategorised

Payment of the 50% of widows’/ widowers’ Pension due to remarriage of widow/ widower (Civil and Armed Forces)

Background

- Provisions have been made by the Widows' and Orphans' (Amendment ) Act No. 08 of 2010 and Widowers' and Orphans' Act No 09 of 2010 to grant entitlement to 50% of the pension which was being paid to widow/ widower, who marry again. Section 07 of Pensions Circular No. 13/2010 is applied in this regard and accordingly arrangements have been made by Pensions Circular No. 03/2013 to secure the rights of orphans of previous marriage, if any, (Legal children of male/female contributor) and to grant a half of the widows'/ widowers' Pension to the widow/ widower, who marry again.

- If the remarriage of a certain retired widow / widower has been made before 17.08.2010 on which the Circular No. 13/2010 came into effect, the last date given to make claims for obtaining 50% of the benefit has expired on 31.12.2014 as per Pensions Circular No. 03/2014.

- If a widow/ widower has entered in another marriage at the time of claiming widows' / widowers' pensions benefits, half of the salary, which was due to be paid from the date of death of male/female contributor but not received, is granted to widow/ widower and if there are legal orphans of male/ female contributor, all the arrears should be accounted in the name of the orphans and 100% of widows orphans pension is granted to orphans. The payment of orphans pension is suspended on completion of the age of 26 years or receiving an employment, whichever occurs first, and the payment of 50% of Widow'/ widowers' orphans pension is considered.

- Further, at the instance, where widow/ widower is divorced from the second marriage, he/she is granted the entitlement only to 50% of widows'/widowers' pension.

Methodology

- In case of a remarriage made whilst receiving a widows'/ widowers' pension, entitlement to 50% of the widows/ widowers' pension is granted from the date of the said marriage as per Pensions Circular No. 13/2010.

- In this respect, section 34 of Widows' and Orphans' Pension Ordinance No. 01 of 1898 and section 18 of Widowers' and Orphans Act No. 23 of 1983 have been cancelled and following new provisions have been made by section 06 of Widows' and Orphans' Pension (Amendment ) Act No. 08 of 2010 and section 04 of Widowers' and Orphans' Pension (Amendment) Act No. 09 of 2010.

Widows' and Orphans' Pension (Amendment ) Act No. 08 of 2010

“ 6. section 34 of the principal enactment is hereby repealed and the following new section is substituted thereafter:

34. (1) The widow of a contributor shall , on her remarriage, receive as pension after the date of such subsequent marriage,

- (a) half the amount of the pension which she was receiving at the time of such subsequent marriage or

- (b) where she was entitled to receive a pension but was not in actual receipt of the same, half of the amounts she was to receive in her capacity as a widow prior to such subsequent marriage.

(2) The children of the first marriage of the widow shall receive the remaining portion of the pension received by the widow after the payment to the widow is made in terms of paragraph (a) or (b) above.

(3)Where the spouse of such subsequent marriage is also a contributor to the fund and where such widow becomes entitled to receive a pension upon the death of such spouse in respect of the contributions made to the fund by such spouse, the payment of such amount as she was receiving as pension in terms of paragraph (a) and (b ) of subsection (1) shall be terminated with effect from the date of death of such spouse of such subsequent marriage:

Provided that where the payment of the pension is terminated as provided above, the children of the first marriage of the widow shall, as from the date of death of the spouse of their mother's subsequent marriage, be entitled to receive the shares they were receiving in terms of subsection (2) and the amount which their mother was receiving in terms of subsection (1), prior to such termination:

Provided further that in the event of the dissolution of such subsequent marriage, the widow shall be entitled to receive as pension the half share she received in terms of subsection (1) and the entitlement of the children under subsection (2) remains unchanged.”

Widowers' and Orphans' Pension (Amendment) Act No. 09 of 2010.

“4. Section 18 of the principal enactment is hereby repealed and the following new section is substituted thereof:

18. (1) The widower of a contributor shall in his re marriage receive as pension after the date of such subsequent marriage,

- (a) half the amount of the pension which he was receiving at the time of such subsequent marriage or

- (b) where he was entitled to receive a pension but was not in actual receipt of the same, half of the amounts he was to receive in her capacity as a widow prior to such subsequent marriage

(2) The children of the first marriage of the widower shall receive the remaining portion of the pension received by the widower after the payment to the widower is made in terms of paragraph (a) or (b) of subsection 1. .

(3) Where the spouse of such subsequent marriage is also a contributor to the fund and where such widower becomes entitled to receive a pension upon the death of such spouse in respect of the contributions made to the Pension Scheme by such spouse, the payment of such amount as he was receiving as pension in terms of paragraph (a) and (b ) of subsection (1) shall be terminated with effect from the date of death of such spouse of such subsequent marriage:

Provided that where the payment of the pension is terminated as provided above, the children of the first marriage of the widower shall, as from the date of death of the spouse of their father's subsequent marriage, be entitled to receive the shares they were receiving in terms of subsection (2) and the amount which their father was receiving in terms of subsection (1), prior to such termination:

Provided further that in the event of the dissolution of such subsequent marriage, the widower shall be entitled to receive as pension the half share she received in terms of subsection (1) and the entitlement of the children under subsection (2) remains unchanged.”

- From the date of the remarriage of the spouse, the entitlement to 50% of widows' and orphans' pension or 50% of the widowers and orphans' pension is granted.

Documents required for the purpose

- PD 4 application

- Death certificate of the contributor - First copies obtained from Additional District/ District Registrar

- Birth certificate of the contributor - First copies obtained from Additional District/ District Registrar

- Birth certificate of the spouse - First copies obtained from Additional District/ District Registrar

- Marriage certificate

- Certified copy of the National Identity Card of the contributor

- Certified copy of the National Identity Card of the spouse

- Certified copy of the bank pass book of spouse

- A proper certification from the Head of Institution, if any difference is found in the name of the contributor

- A proper affidavit or legal document to certify differences in the name of spouse, if such difference is found

- Following documents of the previous of the spouse or contributor, if there are such previous marriages,

- Marriage certificates

- Divorce certificates to prove the way such marriages come to end (For Muslim and Kandyan marriages)

- Absolute order of the divorce

- Death certificate

- Birth certificates and bank details of the unemployed children below age of 26 years, who are from previous marriage of the contributor

- Documents to prove the employment of orphans who are beyond the age of 26 years

- Certified copies of the N I C of guardians of orphans and certified copies of their pass books of savings bank account

- Marriage certificate to prove the remarriage of widow/widower

For this purpose, documents relevant to all spouses should be submitted.

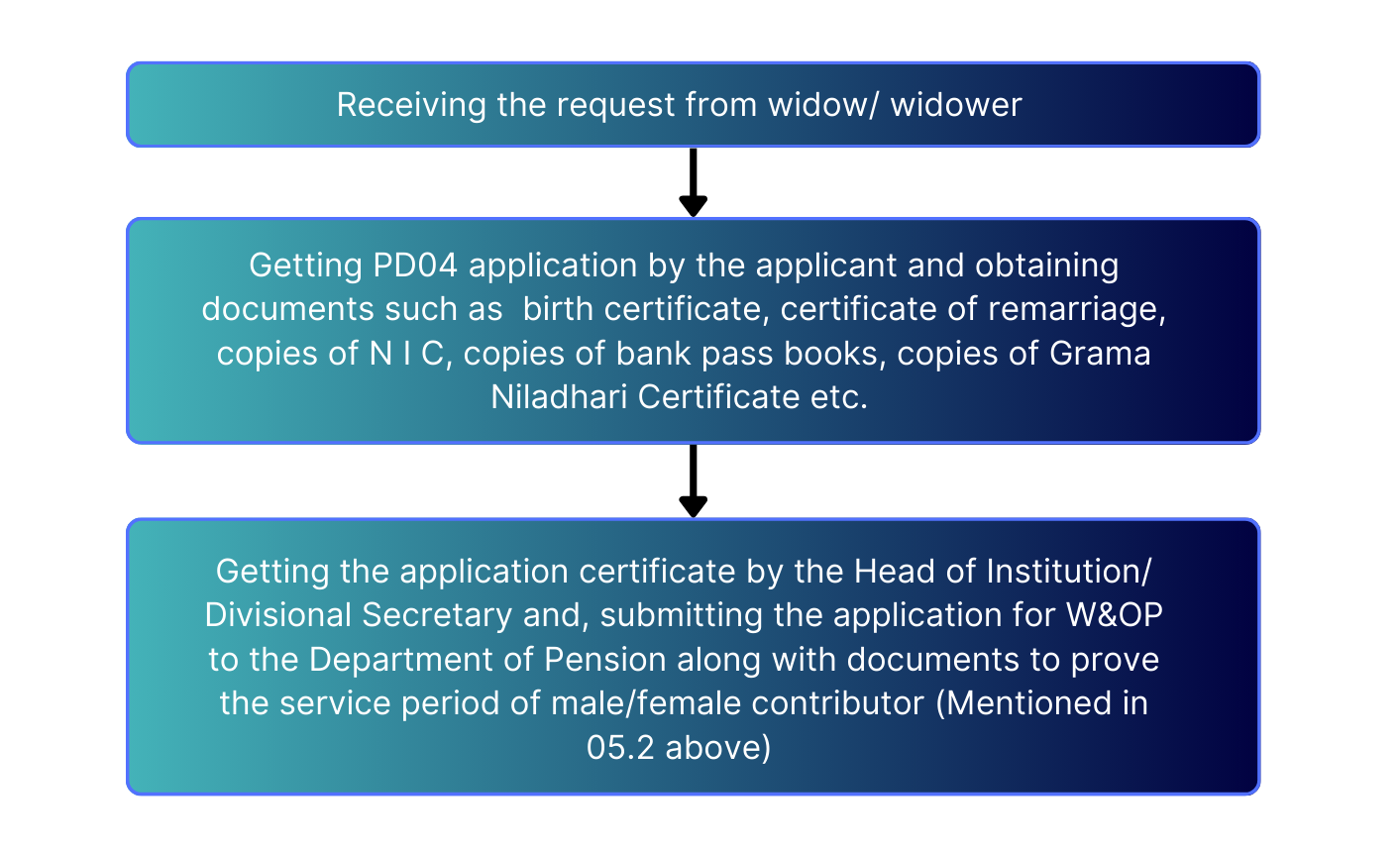

Role of the relevant institutions in the application process

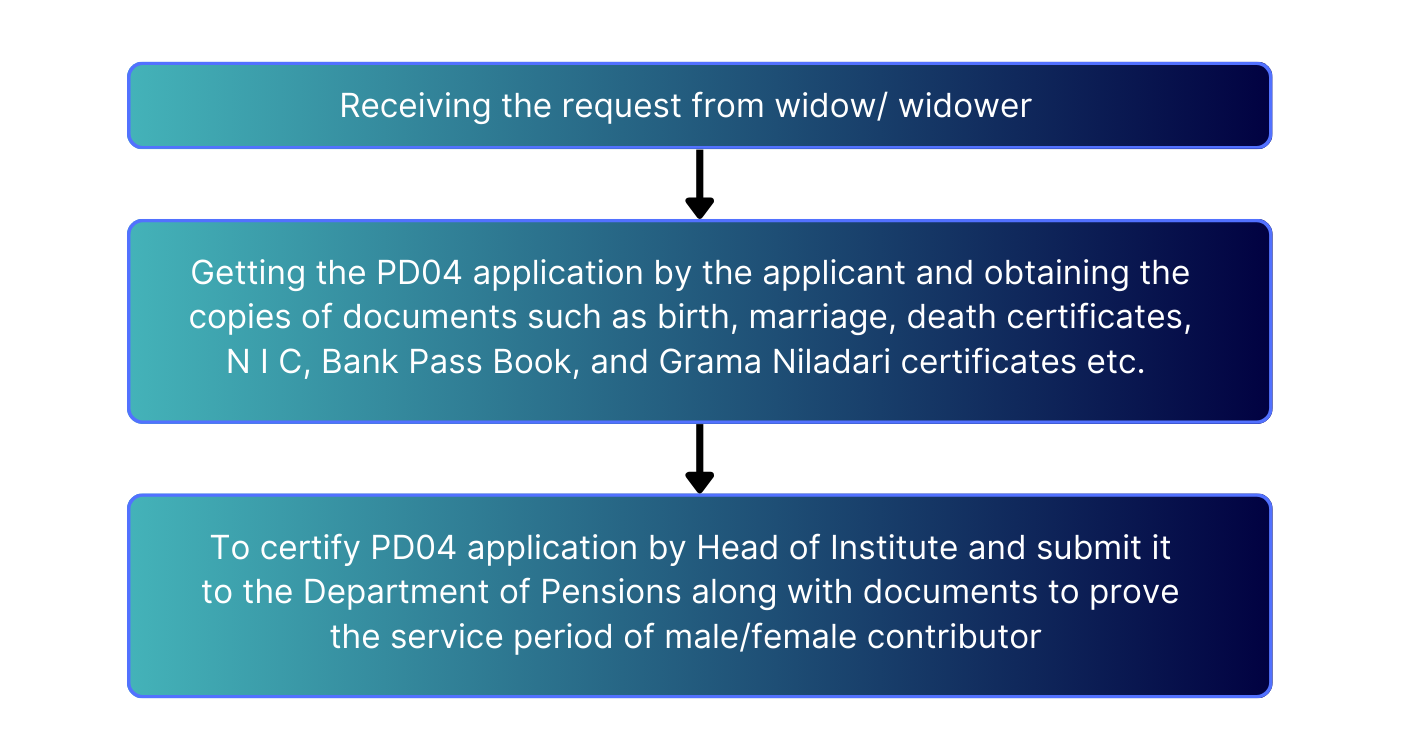

When a receiver of a widow/ widowers' pension is marry again, the application should be submitted through the relevant Divisional Secretariat and the applications of those whose payment of widow'/ widowers' pensions has not been commenced should be submitted through the institute where the male/ female contributor served for the last time

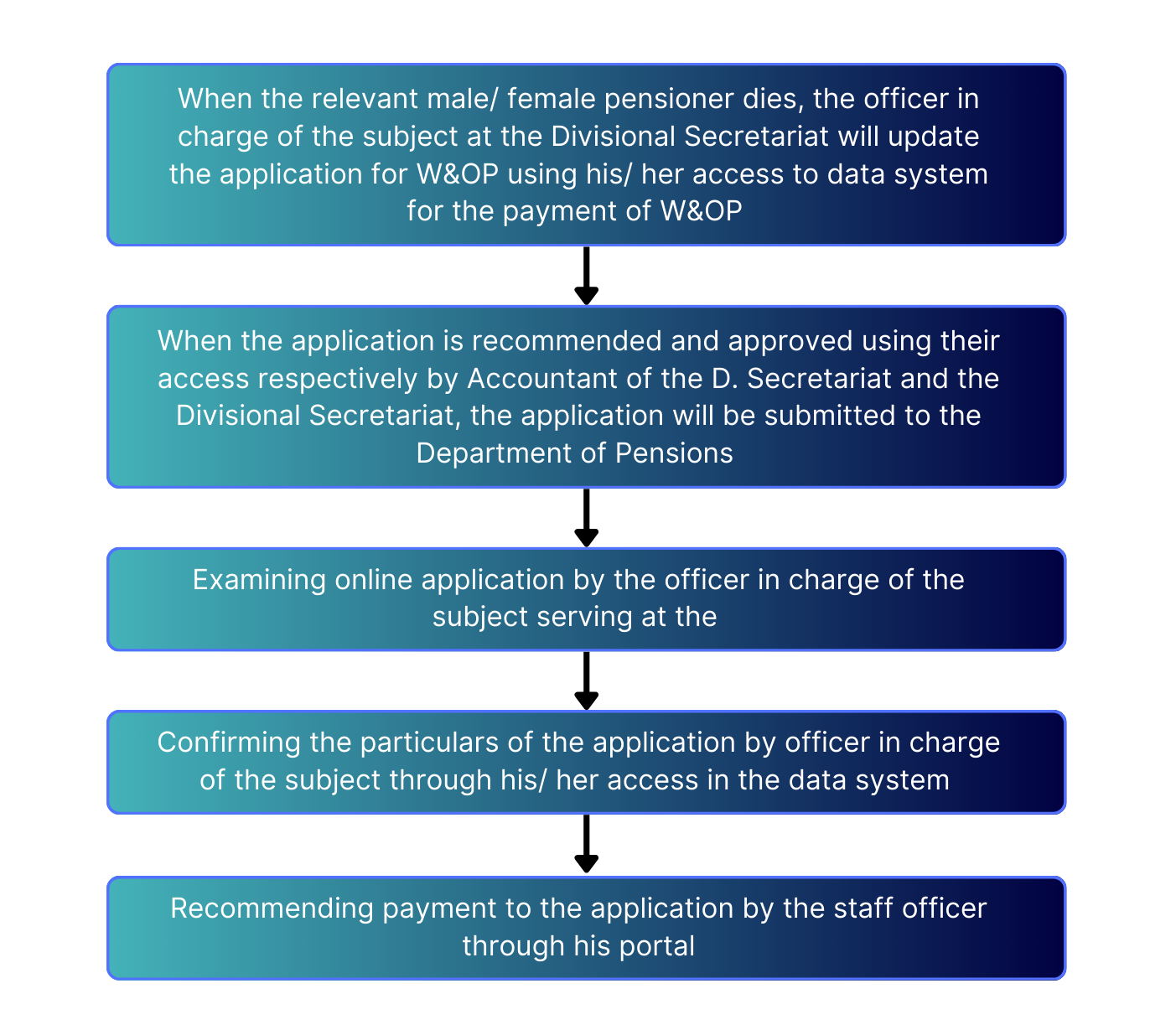

The officers in charge of the subject and serving attached to Divisional Secretariats should submit applications connected to the files, which have no issues, through DS Portal system using their access.

The applications pertaining to the files, which are with issues such as differences in names, obtaining excess amount of W&OP without informing about remarriages, changes occurred in residences etc., should be submitted to the Department of Pensions through non online system under Pensions Circular No. 06/2015 (1).

Acts, Ordinances and Circulars applied

- Widows’ and Orphans’ Pensions Fund Ordinance No 01 of 1898

- Widowers’ and Orphans’ Pensions Act No 24 of 1983

- Widows’ and Orphans’ Pensions (Amendment) Act No. 08 of 2010

- Widowers’ and Orphans’ Pensions (Amendment ) Act No. 09 of 2010

- Pensions Circular No 01/99 (To prove the employment of the orphan)

- Pensions Circular No 13/2010

- Pensions Circular No 03/2013

- Pensions Circular No 03/2014

- Pensions Circular No 06/2015 හා 06/2015(1)

Category Code numbers applied

- Widows of armed forces, who marry again - 60

- Civil Widows, who marry again - 61

- Widowers, who marry again - 62

Payment of orphans’ pension

In case where the legal spouse is no more living after the death of a male/ female officer, who was serving in public service, to grant entitlement to widows/ widowers pension or the spouse has married again, the orphans’ pension is granted to the unemployed legal children, who are below the age of 26 years.

Methodology

- Payment of orphans’ pension to a minor below the age of 18 years, who is entitled to an orphans’ pension, should be made under the custody of a guardian. For this purpose, the recommendation should be given by the Divisional Secretary depending on the observation of the Grama Niladhari of the area as to whether the guardian is appropriate to be the guardian of the child and whether he/ she is capable to ensure proper education, nutrition, and health facilities to the child. For the payment of pension under such guardianship, approval of the Director General of Pensions should be obtained. It is required to enter in to an agreement by the Guardian and the Director General of Pensions as per Pensions Circular No. 07/2020 and In case where it is revealed that the appointed guardian neglects therefore the Divisional Secretary of the area should enter in to agreement on behalf of the Director General of Pensions.

- In case where it is revealed that the appointed guardian does not provide education, nutrition and health facilities to the child properly, the Divisional Secretary should with immediate effect appoint a new guardian after making a formal inquiry and then approval of the DOP should also be obtained for such appointment.

- When the orphan reaches the age of 18 years, child should be removed from the guardianship and then the payment of pension should strictly be commenced in the name of the orphan and further action should be taken to terminate the payment of orphans’ pension on completion of the age of 26 years or having an employment, whichever occurs first. Here, the pension is credited to an individual savings account operated in the name of the orphan. Further, for the purpose of the employment of the orphan, following matters in section 5 of the Pension Circular No. 01/99 are applicable.

As per the amendment made to the Act, the children of the age of 21 to 26 years are entitled to the pension, until they are unemployed. When determining the employment of an applicant for orphans’ pension, attention should be paid to the following matters.- A pensionable employment in the public service,

- An employment with the membership of a certain employees provident fund,

- Those who go abroad for foreign employment,

- Those who pay income tax under Income Tax Act,

- An owner of a business/ property, which incur an adequate income for living.”

- When this orphans’ pension is paid, the marital status of orphans will not be considered. (Section 4 of Pension Circular No. 13/2010)

- When an entitlement is made to an orphans’ pension, which has been commenced under the guardianship for minors below the age of 18 years, the pension in arrears paid as a lump sum amount, if any, should be deposited in a savings account of a state bank for the wellbeing of the child. Further, an amount given below, which is paid for the guardianship, (Individual savings account of the guardian at state/ private bank) should be directed to the account of the child as deposits. It should be deposited in the following manner,

- Pension = a part of 1/5 up to Rs. 20,000.00,

- Pension = a part of ¼ up to Rs. 20,001.00 from 35,000.00,

- Pension = a part of 1/3 if it is more than Rs. 35,000.00

- The children adopted by a public officer before withdrawing from membership of W&OP scheme should have the entitlement to enjoy benefits of W&OP scheme. For this purpose, section 33 of the main enactment has been revised in the following manner by section 14 of Widows’ and Orphans’ pensions Fund (Amendment) Act No 44 of 1981.

- 14 Section 33 of the principal enactment is hereby amended as follows: (a) by the renumbering of that section as subsection (1) of section 33 ; (b) by the addition, at the end of that subsection, of the following new subsections: " (2) A child adopted under the [Cap. 76] provisions of the Adoption of Children Ordinance or any other law relating to the adoption of children by a married public officer while he is a contributor shall, subject to the provisions of subsection (3) and subsection (4), be treated as a child of the adopter and accordingly such child shall be entitled to a pension under this Ordinance in like manner and to the like amount as a child of such public officer. (3) A child adopted under the [Cap. 76] provisions of the Adoption of Children Ordinance or any other law relating to the adoption of children by a married public officer while he is a contributor shall be entitled to a pension under this Ordinance unless the Director has reason to believe that there was no genuine desire to adopt the child and that the adoption was merely one of convenience: (c) by the substitution, for the marginal note to that section, of the following new marginal note “Pension for the children and adopted children.”.

- Provisions have been made in the following manner on granting entitlement to a child adopted by a female officer to the benefits of W&OP scheme by sub section 17 (2) and (3) of Widowers’ and Orphans’ Pensions Act No. 24 of 1983

(2) A child adopted under the provisions of the Adoption of Children Ordinance or any other law relating to the adoption of children by a married contributor while she is a contributor shall, subject to the provisions of subsection (3), be treated as a child of such contributor and accordingly, such child shall be entitled to a pension under this Act in like manner and to the like amount as a child of such contributor. (3) A child adopted under the provisions of the Adoption of Children Ordinance or any other law relating, to the adoption of children by a married contributor while she is a contributor shall be entitled to a pension under this Act unless the Director has reason to believe was no genuine desire, on the part, of such adopt the child and that the adoption was merely one of convenience: Provided, however, that the Director may authorize the award of a pension to such child if such child does not have an independent source of livelihood and if the Director considers that such award is just and equitable in all the circumstances of the case.

(2) A child adopted under the provisions of the Adoption of Children Ordinance or any other law relating to the adoption of children by a married contributor while she is a contributor shall, subject to the provisions of subsection (3), be treated as a child of such contributor and accordingly, such child shall be entitled to a pension under this Act in like manner and to the like amount as a child of such contributor.

(3) A child adopted under the provisions of the Adoption of Children Ordinance or any other law relating, to the adoption of children by a married contributor while she is a contributor shall be entitled to a pension under this Act unless the Director has reason to believe was no genuine desire, on the part, of such adopt the child and that the adoption was merely one of convenience:

Provided, however, that the Director may authorize the award of a pension to such child if such child does not have an independent source of livelihood and if the Director considers that such award is just and equitable in all the circumstances of the case

Documents required for the purpose

- PD 4 application

When submitting PD4 application, a suitable guardian, who is capable to ensure proper nutrition, education and protection to the orphans below the age of 18 years, should be appointed and the application should be submitted along with the guardian’s recommendation. For the orphans over the age of 18 years, PD$ applications should be submitted separately. In case of a person demised whilst in service, application should be submitted along with the recommendation of the Head of Institute and Grama Niladhari and in case of a death of a person, who demised whilst receiving pension, application should be submitted along with the recommendation of the Divisional Secretary and Grama Niladhari. - Death certificate of the contributor - First copies obtained from Additional District/ District Registrar

- Birth certificate of the contributor - First copies obtained from Additional District/ District Registrar

- Birth certificate of the spouse - First copies obtained from Additional District/ District Registrar

- Marriage certificate

- Certified copy of the N I C of the contributor *

- Certified copy of the N I C of the spouse*

- Certified copies of the bank pass book of orphan and guardian *

- A proper confirmation on the difference in the name of contributor, if any

- An affidavit or proper legal documents to confirm the differences in the name of spouse/ orphans, if any

- Following documents on the previous marriages of contributor or spouse, if any

- Marriage certificates

- Divorce certificates to prove that such marriages have come to end (For Kandyan marriages)

- Absolute order of the divorce

- Originals of death certificate

- Birth certificates and bank details of the children of the contributor's previous marriages, who are unemployed and below the age of 26 years

*To be certified by Grama Niladhari.

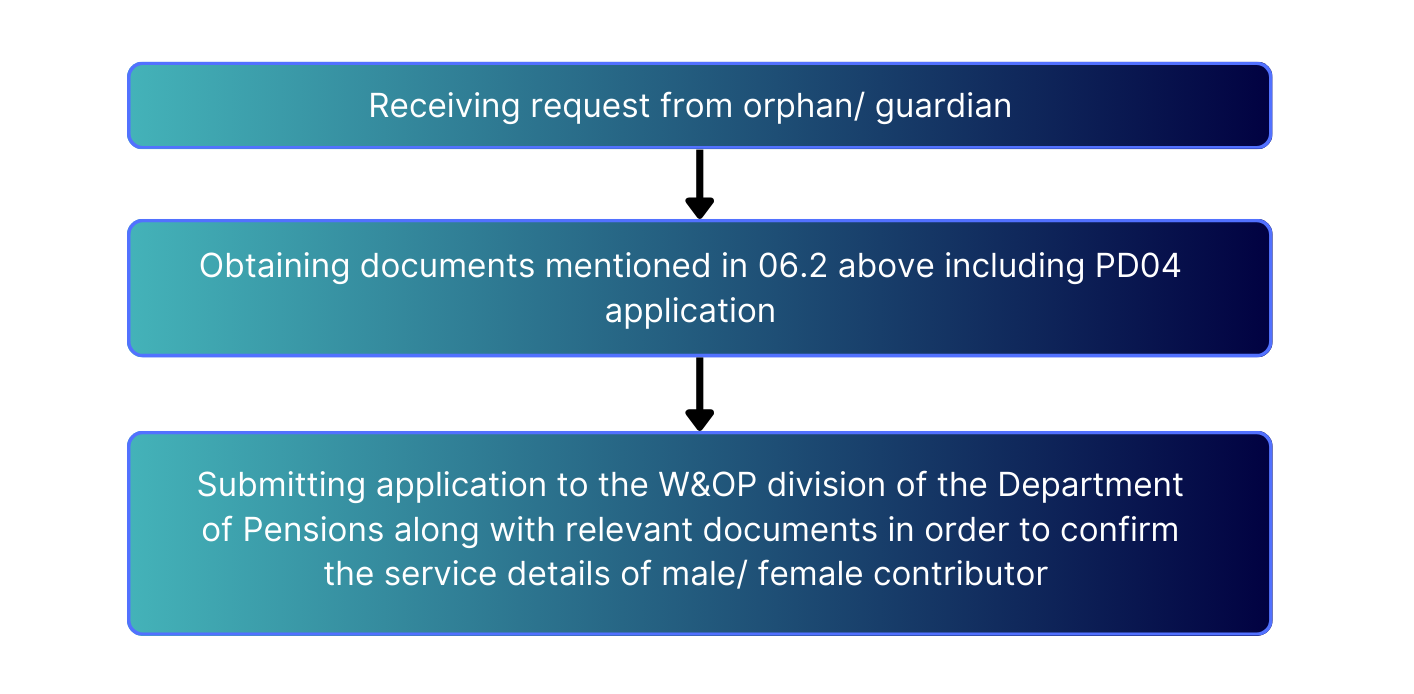

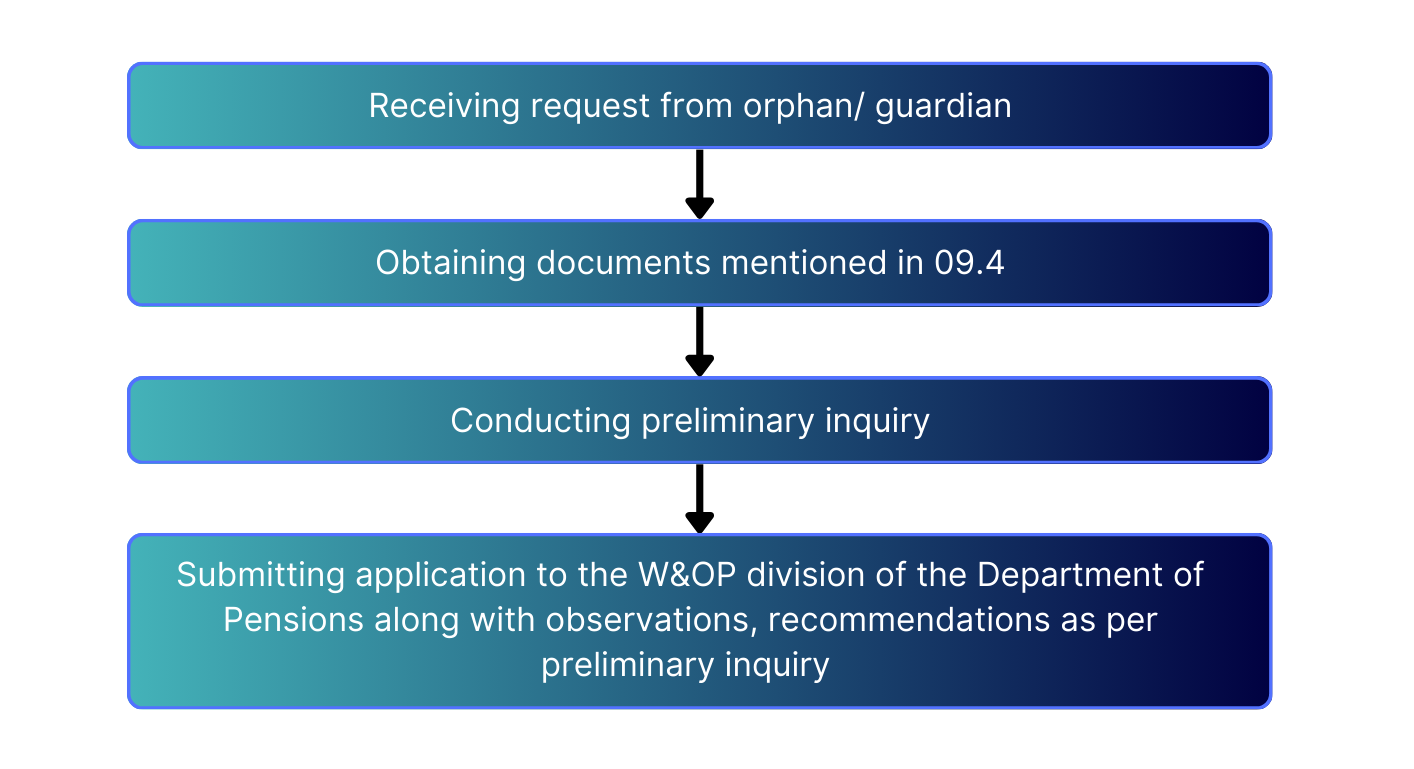

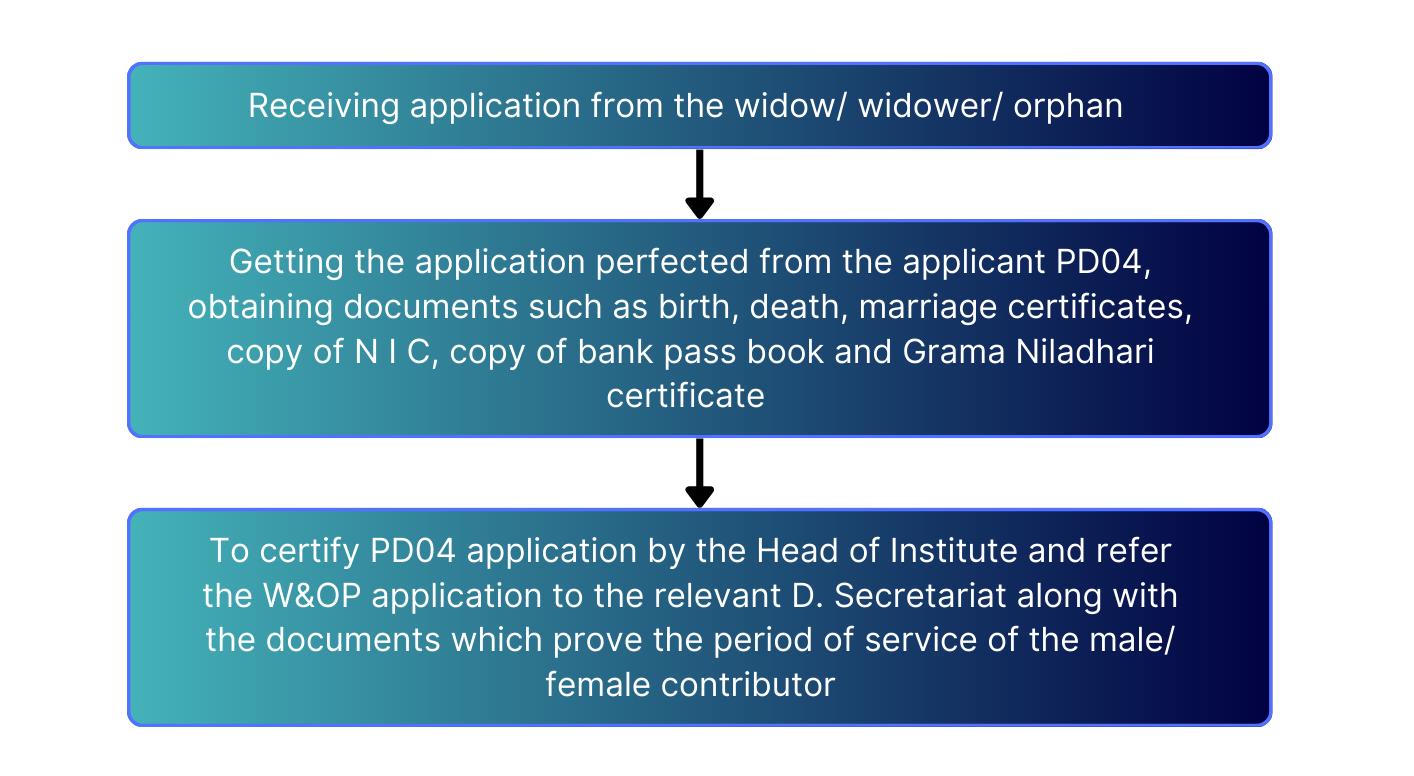

Role of the institution in the application process

- In case of a remarriage/ death of a person, who is receiving widow'/ widowers' pension, the application should be submitted by the relevant Divisional Secretariat and the applications of those, whose widow'/ widowers' pension payment has not been commenced, (Due to the remarriage or death of widow/ widower before commencing the payment of widows'/ widowers' pension)should be submitted to the W&OP division of the Department of Pension by the institute, where the male/female contributor served for the last time

Acts, Ordinances and Circulars applied

- Widows’ and Orphans’ Pension Fund Ordinance No 01 of 1898

- Widowers’ and Orphans’ Pensions Act No. 24 of 1983

- Widows’ and Orphans’ (Amendment) Act No. 57 of 1998

- Widows’ and Orphans’ Pension Fund (Amendment) Act No.08 of 2010

- Widowers’ and Orphans’ Pensions (Amendment) Act No.09 of 2010

- Pension Circular No. 01/99

- Pension Circular No. 13/2010

- Pension Circular No. 06/2015,06/2015(1)

- Pension Circular No. 03/2020

- Pension Circular No. 03/2008(1)

Types of code numbers applied

- Widows' and orphans' pension - 23

- Widowers' and orphans' pension - 27

- Armed forces orphans' pension - 41

- Armed forces Widowers' and orphans' pension - 45

- Widows' and orphans' pension - between the age of 21-26 - 50

- Widowers' and orphans' pension - between the age of 21-26 - 51

- Widowers' and orphans' pension-below and over the age of 21 years - 53

Payment of Disabled Orphans' Pension

This pension is paid to the children who are born to male/ female public officer and with permanent mental or physical disability at the birth or become disable before reaching the age of 26 years which make such child unable to make his/ her living.

For this purpose, following provisions have been made with the inclusion of new section 29 to the previous section 29 by the Gazette Extraordinary No. 1719/3 dated 15.08.2011 and section 11 of Widows' and Orphans' Pension Fund (Amendment) Act No 44 of 1981

“29a. 'When it is decided by a Medical Board consists of three Medical Officers appointed by the Director of Health Services, that the orphan suffers from a physical or mental disability, which makes him/her unable to make livelihood, such orphan shall have the entitlement to a pension for the lifetime irrespective of the age'

Further, regulations have been made also to section 7 of the Widowers' and Orphans' Pension Act by the above mentioned Gazette Extraordinary

Methodology

- In case where widow/ widower is not living to receive benefits for the officers demise whilst in service, it is considered to grant entitlement to orphans' pension to orphans born to the contributor, if there are such orphans.

- Further, when a male/ female pensioner, who is receiving a pension, demises, the entitlement to W&OP is granted to widow/ widower and then to the orphans after the death of widow/ widower.

- The pension file maintained at the Divisional Secretariat should be submitted to the Department of Pensions along with PD4 application perfected for the disabled orphan, application 1 for disability perfected as per Pensions Circular No. 01/2009, Health 309 report, medical reports to confirm that the disability occurred before the age of 26 years, recommendation on the guardian and the report with conclusions, and recommendations after making a preliminary examination.

- In case where both mother and father are contributors of W&OP scheme, the entitlement of both is granted to the orphan.

- In terms of the decision of the Director General of Pensions dated 25.02.2014, the higher salary in full from the salaries mother and father will be paid along with 50% from the lower salary.

- In terms of the policy decision no Pol/14/05/06 of the committee dated 05.08.2014, payment is commenced to the children with born disability based on the date on which the recommendation of the Medical Board is given.

- Further as per the policy decision no Pol/14/05/07 of the committee dated 05.08.2014, payments will be made to children, who are not disabled by birth, directing such children once in five years to a Medical Board for getting a confirmation as to whether the disability still exists.

Role of the institution in the application process

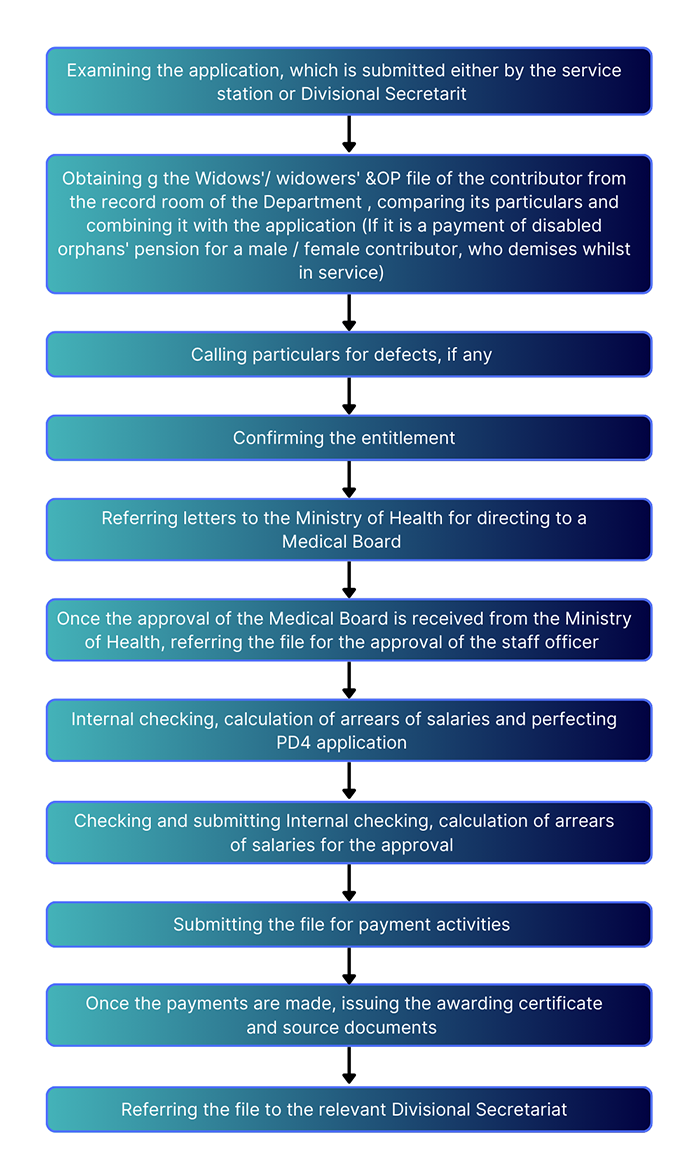

Process to be followed by the Department

Required documents

- PD 4 application

- Application of the Armed Forces (If the male/female contributor is in Armed Forces)

- Disab 1 application

- Death certificate of the Contributor - First copies obtained from Additional District/ District Registrar

- Death certificate of the spouse - First copies obtained from Additional District/ District Registrar

- Birth certificate of the contributor - First copies obtained from Additional District/ District Registrar

- Birth certificate of the spouse - First copies obtained from Additional District/ District Registrar

- Marriage certificate

- Birth certificates of orphan/s

- Certified copy of N I C of the orphan child *

- Certified copy of N I C of the guardian*

- If payment is made to the orphan child, certified copy of the bank pass book *

- If payment is made under the guardianship of a guardian, certified copy of his/ her bank pass book *

- Health 307 report

- Medical reports before the age of 26 years

- Report of the preliminary report conducted by Divisional Secretary and his/ her recommendation

- First pension file

- A proper confirmation , if any difference is found in the name of the contributor

- In case of a previous marriage of contributor or spouse , first copies of the following documents of such marriages

- Marriage certificates

- Divorce certificates to confirm the way of ending such marriage (For Kandyan marriages)

- Absolute order of the divorce

- Death certificate

- If the disabled child is in a children's home , relevant particulars

- Monthly estimate on expenditure

- Documents to prove that such children's home has been registered under Government

- Full photograph of the disabled child

- If the disabled child is married, report of the Divisional Secretary with the recommendation of Grama Niladhari on the child's income/ ownership for properties/income of the family

*To be certified by Grama Niladhari.

*The bank account should be an individual and savings account.

Ordinances, Acts and Circulars applied

- Widows’ and Orphans’ Pension Fund Ordinance No 01 of 1898

- Widows’ and Orphans’ (Amendment) Act No. 57 of 1998

- Widows' and Orphans' Pension(Amendment) Act No. 64 of 1998

- Widows’ and Orphans’ Pension Fund (Amendment) Act No.08 of 2010

- Widowers’ and Orphans’ Pensions Act No. 24 of 1983

- Widowers’ and Orphans’ Pensions (Amendment) Act No.65 of 1998

- Widowers’ and Orphans’ Pensions (Amendment) Act No.02 of 2001

- Widowers’ and Orphans’ Pensions (Amendment) Act No.09 of 2010

- Pension Circular 01/2009 and 01/2009 Revision (1)

- Pension Circular 07/2020 and 07/2020 Revision (1)

- Pension Circular No. 03/2008(1)

Types of code numbers applied

- Widows Disability pension - 24

- Widowers Disability Pension - 28

- Armed Forces Disability Pension - 42

- Armed Forces Widowers Disability Pension - 46

Payment of Armed Forces Widows’ /Widowers’ Pension

Tree Armed Forces

1. Army

2. Navy

3. Air Force

Background

- Granting entitlements to the benefits of W&OP was commenced by Widows' and Orphans' Pensions Scheme (Armed Forces) , which has been introduced in year 1970 for the regular members of three Armed Forces, and series of orders dated 28.11.1970.

- For the first time the benefits of the widows' and orphans' pensions scheme have been granted to the male members of three Armed Forces. Accordingly, benefits of this pensions scheme, which were limited to the males, have been extended also to the female members by way of issuing Widowers' and Orphans' Pensions Scheme (Armed Forces) No 60 of 1998.

- Accordingly, the members, who join regular service after 30.09.1968 become compulsory members and opportunity has also been given to the members, who joined the service prior to the above date, to join as per their option. For the last time, the time for extending option has been extended by Pensions Circular No. 03/2006. That period of extension has also expired by 30.06.2000.

Members of the voluntary armed forces were not entitled to the benefits of this scheme and opportunity has also been given later to the members of the voluntary forces also to get the membership of W&OP scheme by the Pensions Circular No. 10/2009. Accordingly, concessionary periods have been given to them for joining with the scheme on their option and for the last time that has been extended by Pensions Circular No. 02/2012. That date expired on 31.12.2012. - The servicer number of the members of armed forces is their W&OP number but a file is not maintained at the record room of Department of pensions for these members. However the Head of the relevant Armed Force should submit (Director, Salaries and Documents) W&OP application after the demise of the member.

- The entitlement to widows'/ widowers' and orphans' is granted form the day after the death of the member.

Methodology

The first step of the payment process of widows and orphans pension is the submission of application by the three Armed Forces. There are two methods in this regard.

A. Death occur whilst in service

For this purpose, relevant armed force should submit the application for W&OP and other documents to the Department of Pensions as per Pensions Circular No. 06/2015 (1). Entitlement to the widows'/ widowers' pension is hereby granted irrespective of the service period of the member.

However in terms of the regulations of W&OP (Armed Forces) No. 18 of 1970,

27(1) In case, where a contributor demises within 12 months from the date of marriage, and if the contributor has no children from such marriage, the widow of such contributor should not be treated as a beneficiary or a person entitled to the pension, except the provisions made hereinafter'. However the Director can make an order as per his discretion to pay her the full pension or a part of it , for which the widow might have been entitled to , if the provisions mentioned were not existed, and if the Director makes such order, the widow will be entitled to receive such payment and she should be treated as a beneficiary for the purpose of these orders.

(2) “In terms of the authority granted by an order given by the Director conforming to para (1) of these orders, only a part of the pension should be paid to the widow and the remaining part of the pension should be paid to the beneficiary, if there is only one such beneficiary. However such part should be paid in equal parts to beneficiaries, if there are several such beneficiaries.'

At such occasions, the application should be submitted to the Department of Pensions in order to grant pension entitlement to the widow.

Provisions for the widowers have also been made in the following manner by section 26 (1) and (2) of Widowers' and Orphans' Pensions Scheme (Armed Forces) No. 60 of 1998.

“26.(1) In case, where a female contributor demises within 12 months from the date of marriage, and if they have no children from such marriage, the widower of such contributor should not be treated as a beneficiary or a person entitled to the pension, except the provisions made hereinafter'. However the Director can make an order as per his discretion to pay him the full pension or a part of it , for which the widower might have been entitled to , if the provisions mentioned were not existed, and if the Director makes such order, the widower will be entitled to receive such payment and she should be treated as a beneficiary for the purpose of these orders.

(2) “In terms of the authority granted by an order given by the Director conforming to para (1) of these orders, only a part of the pension should be paid to the widower and the remaining part of the pension should be paid to the beneficiary, if there is only one such beneficiary. However such part should be paid in equal parts to beneficiaries, if there are several such beneficiaries.'

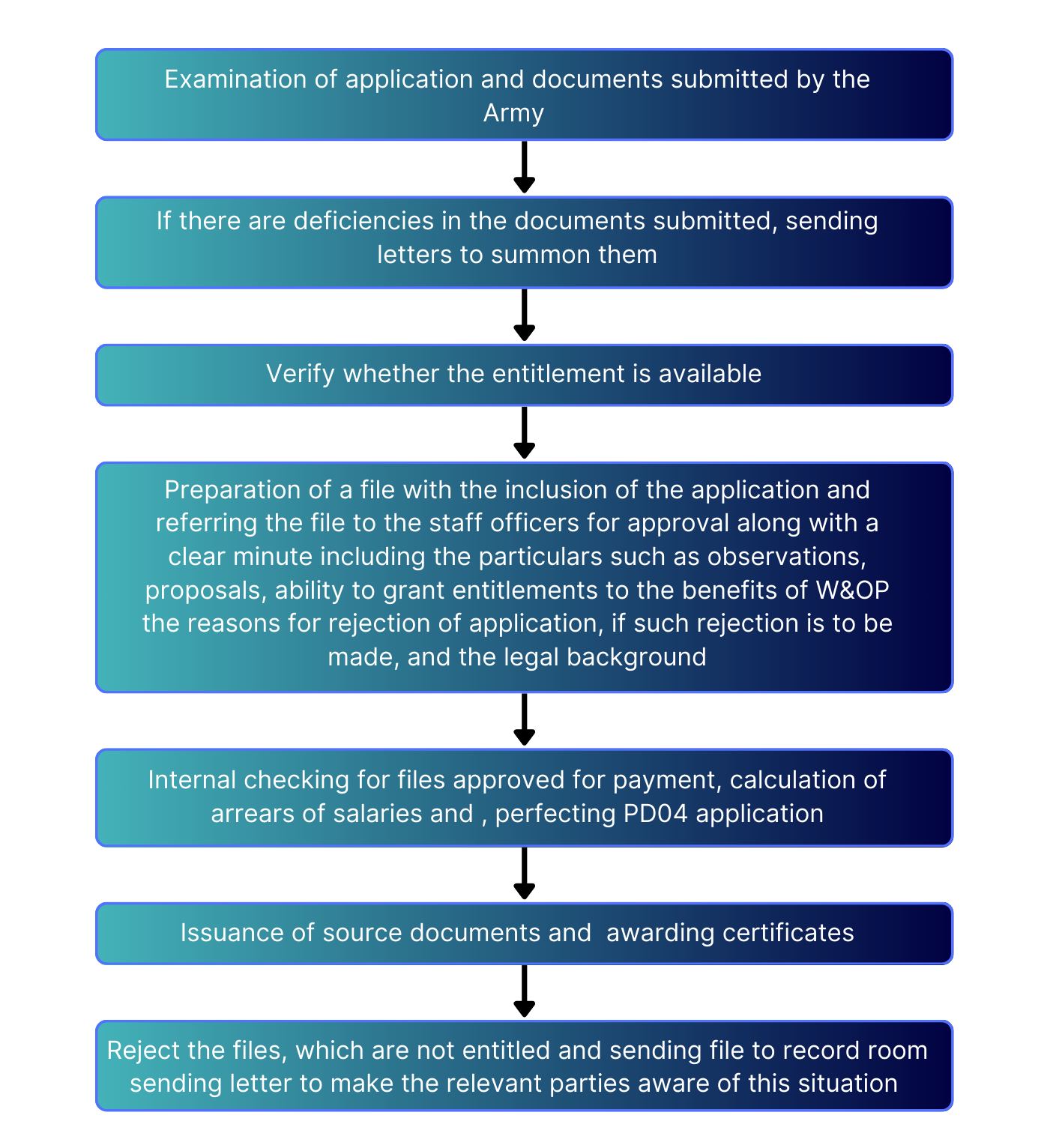

A.1. The role of the relevant institution in the application process

A.2. Process to be followed for an application for W&OP of Armed Forces, which is submitted as per Pensions Circular No. 06/2015 (1)

B. Death after retirement

In order to grant entitlement to W&OP for the members, who dies whilst receiving their pension from the Divisional Secretariat, the application for W&OP (Armed Forces) should be submitted to relevant Divisional Secretariat by the armed force, to which the member belongs. Then, the relevant Divisional Secretariat should take action to refer the W&OP application to the Department of Pension through online system as per Pension Circular No. 03/2020.

B.1. Role of the institute in the application process

B.2. Process to be followed for the applications (Online) submitted as per Pension Circular No. 03/2020

- Since this application is submitted through online system, the civil/ service pension file is called by the Department of Pensions from the Divisional Secretariat , if the arrears exceeds Rs. 7.5 lakhs.. The future activities pertaining to such files called by DOP will be carried out as per Pensions Circular No. 06/2015 (1) and the Department will calculate and refer it for inspection , and further the approval is also granted and the payment is also commenced by the DOP.

Documents to be included in the application

- Application of the armed forces

- PD 4 application

- Death certificate of the contributor - First copies issued by Additional/ District Registrar

- Birth certificate of the contributor - First copies issued by Additional/ District Registrar

- Marriage certificate of the spouse - First copies issued by Additional/ District Registrar

- Marriage certificate

- Certified copy of the N I C of the contributor

- Certified copy of the N I C of the spouse

- Certified copy of the savings bank pass book of the spouse (Individual)

- A proper confirmation from the Head of Institute, if any difference is found in the name of the contributor

- A proper affidavit or legal documents to prove the differences in the name, if any such difference is found in the name of spouse

- If the c contributor or spouse has entered in marriages previously,

- Marriage certificate

- Divorce certificates to confirm that such marriages had come to end (For marriages under Kandyan law )-originals of

- Absolute order of the divorce

- Death certificates

- Birth certificates and bank details of the unemployed children below age of 26 years, who are from previous marriage of the contributor .

- Report of the Divisional Secretary on the present civil status of the contributor

Instances where the application cannot be submitted through online system

Even though opportunity has been provided to submit application through online system by Pensions Circular No 03/2020, there are instances, where such applications are submitted to the Department of Pension by the Divisional Secretariat and armed forces in order to take action as per Pension Circular No. 06/2015 (1) deviating from the online system due to defects in the system. These are such instances.

- Payment of 50% of W&OP when the widow/ widower marries again.

- Non inclusion of the section in the data system, under which the pensioners has been sent on retirement.

- Inability to obtain unreduced salary by the new system .

- Inability to prepare the salary to be included in the system due to unavailability of a first awarding certificate in the file.

- Considerable differences found in the contributor or spouse

- Reporting information on polygamy and issues on marriages.

- Making claims by another widow when payments are made to one widow .

- Payment of disabled and orphans pension

- Commencement of the payment of orphans' pension.

- Changing guardians of the orphans.

- Finding excess payments .

- The death of the contributor without pension rights.

When the orphans of the contributor are living under other guardians as a result of neglecting them by the spouse.

When W&OP entitlement is granted for male/ female members of Armed Forces, it has been stipulated by the section 36 of the Widowers and Orphans Pensions Scheme (Armed Forces) No 60 of 1998 and Section 37 of Widows and Orphans Pensions Scheme (Armed Forces) No 18 0f 1970 that issues arisen on the pension to be paid to a certain beneficiary, entitlement of a certain person or the provisions or interpretations of the Act, should be submitted to the Secretary of the Ministry of Public Administration, Home Affairs, Provincial Councils and Local Government and further the decision of the Secretary of the aforesaid Ministry should be the final.

Ordinances, Acts and Circulars which are applied for the purpose

- Widows’ and Orphans Pensions Scheme (Armed Forces) No. 18 0f 1970

- Widowers’ and Orphans Pensions Scheme (Armed Forces) No. 60 0f 1998

- Widows’ and Orphans Pensions Scheme (Armed Forces) No.18 f 1985

- Widows and Orphans’ Pensions (Amendment) Act No. 55 of 1999

- Widows’ and Orphans’ Pension Scheme (Armed Forces) (Amendment) Act, No. 29 of 2009 2

- Widows and Orphans’ Pensions (Amendment) Act No. 08 of 2010

- Widows and Orphans’ Pensions (Amendment) Act No.09 of 2010

- Pension Circular No. 03/2006 - For exercising the option of the members of regular service, who joined the service before 30.06.1968, to get the membership of W&OP.

- Pension Circular No. 04/2009 - Instructions and code numbers for the payment of armed forces W&OP to District and Divisional Secretariats ප්රා

- Pension Circular No. 10/2009 - For exercising the option of the male/ female members of voluntary forces, to get the membership of W&OP and grant entitlement to the same.

- Pension Circular No. 13/2010

- Pension Circular No. 02/2012 - Extending the period given to the members of the male/ female members of voluntary forces, to get the membership of W&OP.scheme

- Pension Circular No. 06/2015(1)

- Pension Circular No. 03/2020

- Pension Circular No. 03/2008(1) - Recovery of arrears of contributions

Type of code numbers applied

- Armed Forces Widows Pension - 40

- Armed Forces Widowers Pension - 44

Notices

Notices